We then discuss the risks associated with credit derivatives, such as moral hazard and other incentive problems, limited disclosure, potential systemic risk, high transaction costs, and the mispricing of credit. The SPE finances its purchase by issuing financial instruments to investors, but these instruments are backed by credit default swaps rather than any actual bonds.In the Article’s first substantive part, we discuss the benefits associated with both types of credit derivatives, which include increased opportunities for hedging, increased liquidity, reduced transaction costs, and a deeper and potentially more efficient market for trading credit risk. In a “synthetic” CDO, the SPE does not purchase actual bonds, but instead enters into several credit default swaps with a third party, to create synthetic exposure to the outstanding debt issued by a range of companies. In a “cash flow” CDO, the SPE purchases a portfolio of outstanding debt issued by a range of companies, and finances its purchase by issuing its own financial instruments, including primarily debt but also equity. If the company defaults on its debt, the bank will lose money on the loan, but make money on the swap conversely, if the company does not default, the bank will make a payment to the third party, reducing its profits on the loan.Second, a collateralized debt obligation (CDO) is a pool of debt contracts housed within a special purpose entity (SPE) whose capital structure is sliced and resold based on differences in credit quality. For example, a bank that has loaned $10 million to a company might enter into a $10 million credit default swap with a third party for hedging purposes. First, a credit default swap is a private contract in which private parties bet on a debt issuer’s bankruptcy, default, or restructuring. Our research suggests that there are two major categories of credit derivative. We also hope to create a framework for a more general scholarly discussion of credit derivatives.We define credit derivatives as financial instruments whose payoffs are linked in some way to a change in credit quality of an issuer or issuers.

We survey the benefits and risks of credit derivatives, particularly as the use of these instruments affect the role of banks and other creditors in corporate governance. In this Article, we begin what we believe will be a fruitful area of scholarly inquiry: an in-depth analysis of credit derivatives. However, it is stated that these derivative disasters could have been prevented with the presence of proper regulations, adequate corporate internal control systems and also with a sound understanding of the nature of the derivatives one deals with.

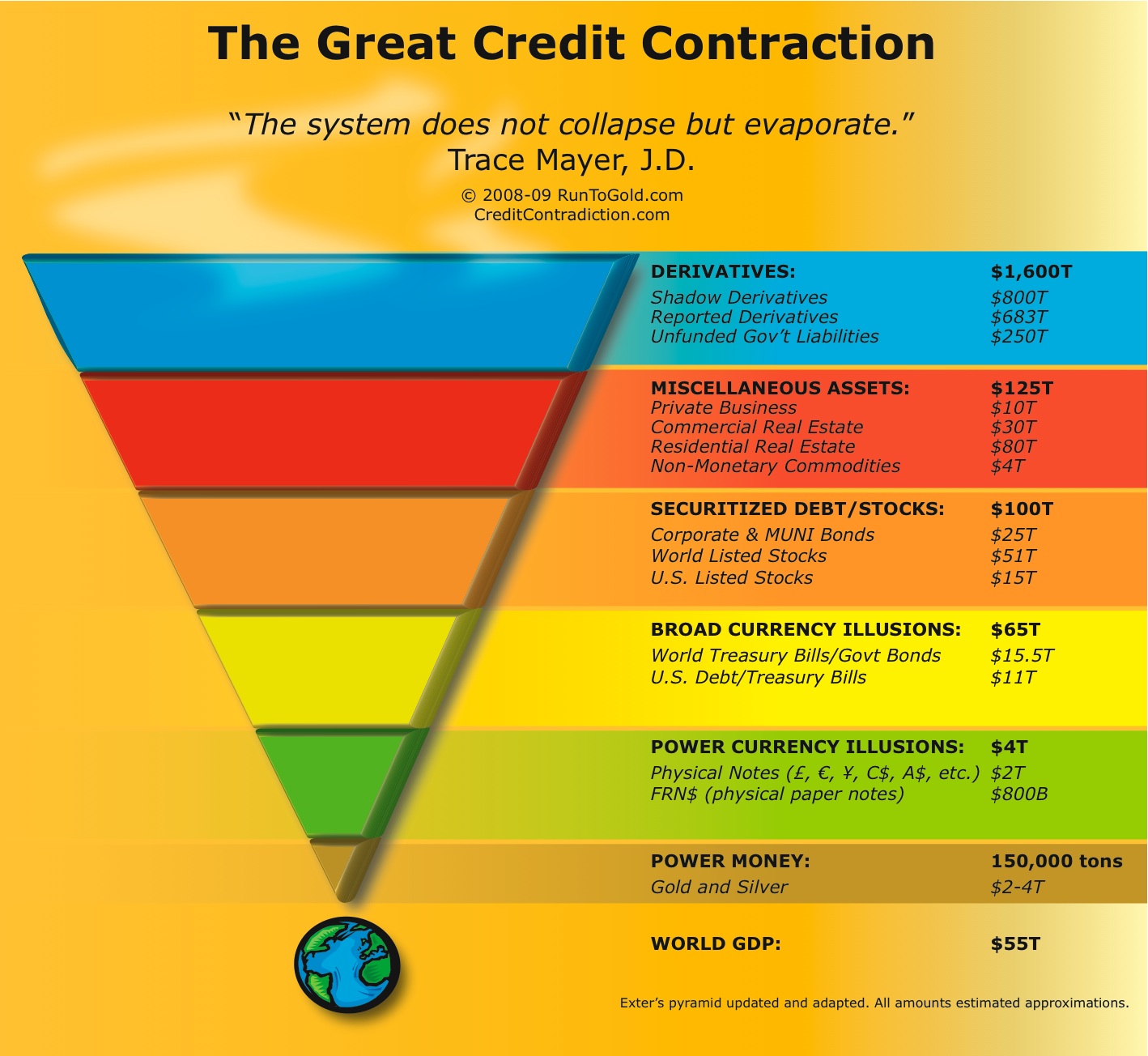

In the light of the derivative disasters, 2008 global recession, this article concludes that Buffett‟s statement was correct to a great extent since derivatives are financially lethal in the absence of an effective risk control mechanism. In this context, after an analysis of the nature and the types of derivatives, the article seeks to evaluate whether these financial instruments, derivatives, are in fact a cause of financial destruction than a cause which brings forth financial benefits, with reference to several controversial derivative disasters. As once pointed out by Warren Buffet, “Derivatives are financial weapons Even though, these instruments are used to deal with the inherent risk associated with finance, they can be the cause of destruction if not used cautiously. With the total notional amounts outstanding on over-the-counter derivative contracts amounting to around nine times global GDP by the end of June 2012, they represent by far the largest financial transaction in the world. The growth of the amount of financial derivatives during the last fifteen years has been phenomenal.

0 kommentar(er)

0 kommentar(er)